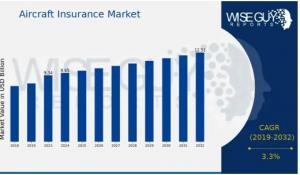

Aircraft Insurance Market to Reach USD 12.5 Billion by 2032, Growing at a 3.3% CAGR Driven by Air Traffic Expansion

The global aircraft insurance market is segmented by several critical factors, including policy type, aircraft type, coverage type, distribution channel, and region. These segments allow for an in-depth analysis of market dynamics, offering key insights for stakeholders such as insurance providers, aviation companies, and investors.

𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲" - 𝐀𝐜𝐜𝐞𝐬𝐬 𝐚 𝐜𝐨𝐦𝐩𝐥𝐢𝐦𝐞𝐧𝐭𝐚𝐫𝐲 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐨𝐮𝐫 𝐫𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐞𝐱𝐩𝐥𝐨𝐫𝐞 𝐢𝐭𝐬 𝐜𝐨𝐧𝐭𝐞𝐧𝐭 𝐚𝐧𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

https://www.wiseguyreports.com/sample-request?id=643243

𝐏𝐨𝐥𝐢𝐜𝐲 𝐓𝐲𝐩𝐞: 𝐀 𝐃𝐢𝐯𝐞𝐫𝐬𝐞 𝐑𝐚𝐧𝐠𝐞 𝐨𝐟 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐎𝐩𝐭𝐢𝐨𝐧𝐬

The aircraft insurance market offers a variety of policy types designed to meet the diverse needs of aviation operators. Among the most common policy types are hull insurance, liability insurance, loss of license insurance, and aviation product liability insurance. Hull insurance protects against physical damage to an aircraft, covering the costs of repair or replacement following accidents or incidents. Liability insurance, on the other hand, safeguards operators against third-party claims for damages caused by accidents. This type of insurance is particularly important as aviation-related incidents can lead to substantial financial claims.

Loss of license insurance provides financial support to pilots or crew members in the event that they lose their medical or flying license, which can severely impact their ability to continue working in the aviation industry. Meanwhile, aviation product liability insurance offers protection against damages caused by defective products or components used in aircraft, covering manufacturers, suppliers, and operators from legal and financial risks.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬

Travelers, Berkshire Hathaway, Aon, Marsh, Old Republic Aerospace, Willis Towers Watson, United States Aviation Underwriters, AssuredPartners, Lloyd's of London, AIG, The Hartford, AXA, Allianz, QBE Insurance, Chubb

𝐀𝐢𝐫𝐜𝐫𝐚𝐟𝐭 𝐓𝐲𝐩𝐞: 𝐄𝐱𝐩𝐚𝐧𝐝𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐜𝐫𝐨𝐬𝐬 𝐕𝐚𝐫𝐢𝐨𝐮𝐬 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐬

The aircraft insurance market is also segmented by aircraft type, with policies tailored to the needs of different segments such as commercial aircraft, private aircraft, cargo aircraft, and military aircraft. Commercial aircraft, including passenger jets and regional aircraft, dominate the market due to the high volume of air traffic and the larger scale of operations. As the global air travel industry grows, the demand for insurance coverage for commercial aircraft is expected to increase proportionally.

Private aircraft insurance covers smaller planes used for personal or business travel. This market is growing steadily, particularly with the increasing popularity of private aviation among high-net-worth individuals and business executives. Cargo aircraft insurance is another key segment, driven by the growth of global trade and the expansion of air freight services. Military aircraft insurance, while a smaller segment of the market, remains essential for defense operations and government agencies, ensuring that military assets are adequately covered against risks.

"𝐁𝐮𝐲 𝐍𝐨𝐰" - 𝐓𝐚𝐤𝐞 𝐢𝐦𝐦𝐞𝐝𝐢𝐚𝐭𝐞 𝐚𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐩𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐭𝐡𝐞 𝐟𝐮𝐥𝐥 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐚𝐜𝐜𝐞𝐬𝐬 𝐚𝐥𝐥 𝐭𝐡𝐞 𝐯𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐢𝐭 𝐜𝐨𝐧𝐭𝐚𝐢𝐧𝐬:

https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=643243

𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐓𝐲𝐩𝐞: 𝐓𝐚𝐢𝐥𝐨𝐫𝐞𝐝 𝐒𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐬 𝐟𝐨𝐫 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 𝐍𝐞𝐞𝐝𝐬

The aircraft insurance market is also defined by various coverage types. Comprehensive coverage is one of the most sought-after options, providing all-encompassing protection against a wide range of risks, including damage to the aircraft, third-party liability, and loss of income due to accidents. Third-party liability coverage is specifically designed to protect operators from legal and financial claims resulting from accidents involving third parties, such as passengers or other aircraft.

Ground risk hull insurance covers the aircraft when it is on the ground, protecting against damage caused by incidents such as fire, theft, or vandalism. Passenger liability insurance is another essential coverage, providing protection for both passengers and crew in the event of an accident or injury. This coverage is particularly critical given the high value of human life and the potential for extensive medical expenses.

𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥𝐬: 𝐄𝐯𝐨𝐥𝐯𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐀𝐜𝐜𝐞𝐬𝐬

In terms of distribution channels, the aircraft insurance market has seen a shift towards digital platforms in recent years. While traditional methods such as direct sales, brokers, and insurance agents remain prevalent, online platforms have become an increasingly popular avenue for purchasing insurance. The rise of digital insurance solutions provides customers with greater convenience, more competitive pricing, and a more transparent understanding of policy options.

Insurance brokers and agents continue to play an essential role in the market by offering personalized advice, facilitating claims processes, and navigating the complex regulatory environment of aviation insurance. Direct sales, typically involving insurers working directly with aviation operators, also remain a common method of distribution, particularly for large corporations with established relationships with insurance providers.

"𝐁𝐫𝐨𝐰𝐬𝐞 𝐑𝐞𝐩𝐨𝐫𝐭" - 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭'𝐬 𝐜𝐨𝐧𝐭𝐞𝐧𝐭𝐬, 𝐬𝐞𝐜𝐭𝐢𝐨𝐧𝐬, 𝐚𝐧𝐝 𝐤𝐞𝐲 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐛𝐲 𝐛𝐫𝐨𝐰𝐬𝐢𝐧𝐠 𝐭𝐡𝐫𝐨𝐮𝐠𝐡 𝐢𝐭𝐬 𝐝𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧:

https://www.wiseguyreports.com/reports/aircraft-insurance-market

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬: 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬 𝐀𝐜𝐫𝐨𝐬𝐬 𝐊𝐞𝐲 𝐑𝐞𝐠𝐢𝐨𝐧𝐬

The aircraft insurance market is geographically diverse, with significant variations in demand, policy types, and regulations across different regions. North America holds a dominant position in the global market due to the large number of commercial and private aircraft operating in the region. The United States, in particular, is a key player, with its well-established aviation industry, extensive air traffic network, and robust regulatory framework. The demand for aircraft insurance in North America is expected to continue growing as the region’s aviation industry expands, driven by increasing passenger traffic and technological innovations.

Europe follows closely behind in terms of market share, with a strong focus on both commercial and private aviation. The European market is characterized by stringent regulations and a highly competitive insurance landscape, which encourages innovation in policy offerings. Furthermore, Europe is home to numerous international airlines, aircraft manufacturers, and maintenance companies, all of which contribute to the demand for comprehensive insurance solutions.

In the Asia Pacific region, the aircraft insurance market is experiencing rapid growth, fueled by the booming aviation industry in countries such as China, India, and Japan. As the middle class in these countries grows, so does the demand for air travel, leading to a significant increase in the number of commercial and private aircraft. Additionally, the rise of air cargo services in the region is driving demand for specialized insurance coverage.

The Middle East and Africa region represents a smaller yet growing segment of the aircraft insurance market. The Middle East, in particular, is home to some of the world’s largest airlines, such as Emirates and Qatar Airways, which have significantly increased demand for aviation insurance. While the market in Africa is still in its nascent stages, there is growing interest in expanding air travel and cargo services, which could contribute to increased demand for insurance coverage.

South America, though smaller in comparison to other regions, is also witnessing growth in its aviation insurance market, primarily driven by increasing demand for commercial aircraft and cargo services. Countries such as Brazil are playing a central role in the region's growth, with improving infrastructure and rising air traffic contributing to the expansion of the aviation sector.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 𝐚𝐧𝐝 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐭𝐨 𝟐𝟎𝟑𝟐

Looking ahead, the aircraft insurance market is expected to grow at a healthy rate through 2032, fueled by several key trends. These include the continued growth of global air travel, the expansion of private aviation, technological advancements in aircraft design and safety, and the rising demand for air cargo services. Additionally, the increasing complexity of aviation operations and the emergence of new risks will drive innovation in insurance products, prompting insurers to offer more tailored and flexible coverage options.

As regional markets continue to evolve, insurers will need to adapt their offerings to meet the unique needs of different geographies. Technological advancements such as digital platforms and data analytics will play an increasingly important role in reshaping the distribution and pricing of insurance products, making it essential for insurance providers to remain agile and responsive to market trends.

In conclusion, the aircraft insurance market is poised for significant expansion over the next decade, driven by increasing demand for both commercial and private aircraft, technological advancements, and evolving market dynamics across different regions. Insurance providers who are able to adapt to these changing needs and offer innovative solutions will be well-positioned to capitalize on the growing opportunities in the global aviation sector.

𝐓𝐚𝐛𝐥𝐞 𝐨𝐟 𝐂𝐨𝐧𝐭𝐞𝐧𝐭𝐬

1: EXECUTIVE SUMMARY

2: MARKET INTRODUCTION

3: RESEARCH METHODOLOGY

4: MARKET DYNAMICS

5: MARKET FACTOR ANALYSIS

6: QUANTITATIVE ANALYSIS

7: COMPETITIVE ANALYSIS

𝐃𝐢𝐬𝐜𝐨𝐯𝐞𝐫 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐨𝐧 𝐀𝐞𝐫𝐨𝐬𝐩𝐚𝐜𝐞 𝐚𝐧𝐝 𝐃é𝐟𝐞𝐧𝐬𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐖𝐢𝐬𝐞 𝐆𝐮𝐲 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐀𝐢𝐫𝐜𝐫𝐚𝐟𝐭 𝐌𝐑𝐎 𝐌𝐚𝐫𝐤𝐞𝐭

https://www.wiseguyreports.com/reports/commercial-aircraft-mro-market

𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐇𝐞𝐥𝐢𝐜𝐨𝐩𝐭𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭

https://www.wiseguyreports.com/reports/commercial-helicopter-market

𝐂𝐨𝐮𝐧𝐭𝐞𝐫-𝐔𝐀𝐒 𝐌𝐚𝐫𝐤𝐞𝐭

https://www.wiseguyreports.com/reports/counter-uas-market

𝐀𝐢𝐫 𝐂𝐡𝐚𝐫𝐭𝐞𝐫 𝐒𝐞𝐫𝐯𝐢𝐜𝐞

https://www.wiseguyreports.com/reports/air-charter-service-market

𝐄𝐥𝐞𝐜𝐭𝐫𝐢𝐜 𝐏𝐫𝐨𝐩𝐮𝐥𝐬𝐢𝐨𝐧 𝐒𝐚𝐭𝐞𝐥𝐥𝐢𝐭𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

https://www.wiseguyreports.com/reports/electric-propulsion-satellite-market

𝐀𝐛𝐨𝐮𝐭 𝐖𝐢𝐬𝐞 𝐆𝐮𝐲 𝐑𝐞𝐩𝐨𝐫𝐭𝐬

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐒

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Sales :+162 825 80070 (US) | +44 203 500 2763 (UK)

Mail: info@wiseguyreports.com

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Distribution channels: Aviation & Aerospace Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release